Car allowance tax calculator

As amended upto Finance Act 2022. 28 August 2016 at 1131AM.

2022 Everything You Need To Know About Car Allowances

A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

. Tax payments 3. 2022 Car Allowance Calculator. You would pay 23500 for the vehicle.

Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is. Information relates to the law prevailing in the year of. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

In this case Florida collects a 6 sales tax on 24000. Automobile Benefits Online Calculator - Disclaimer. Payment of a car allowance gives rise to a number of tax questions.

Select the nature of. Super contribution caps 2021 - 2022 -. An Employers Guide Croner.

Payment of a car. Income Tax Department Tax Tools MotorCar Calculator. Taxability of other than Car Perquisite.

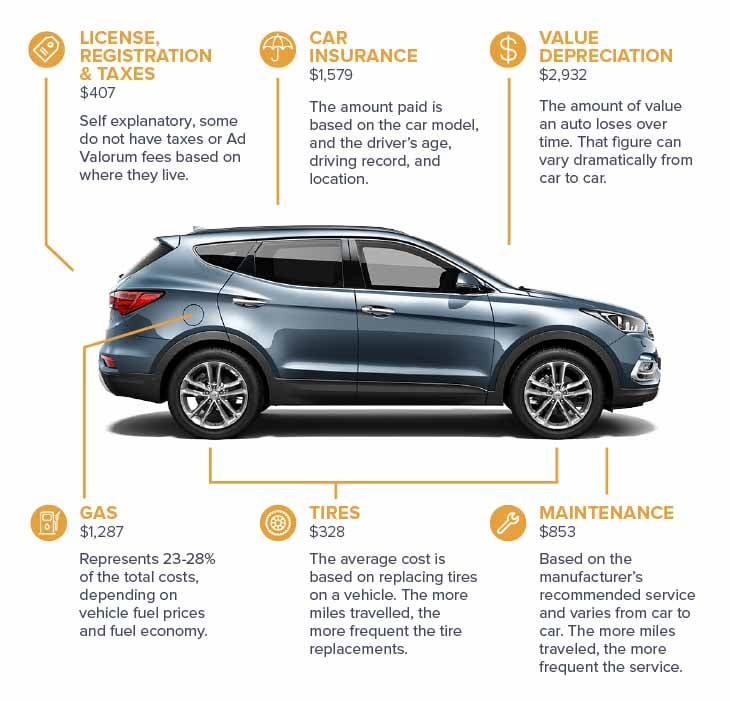

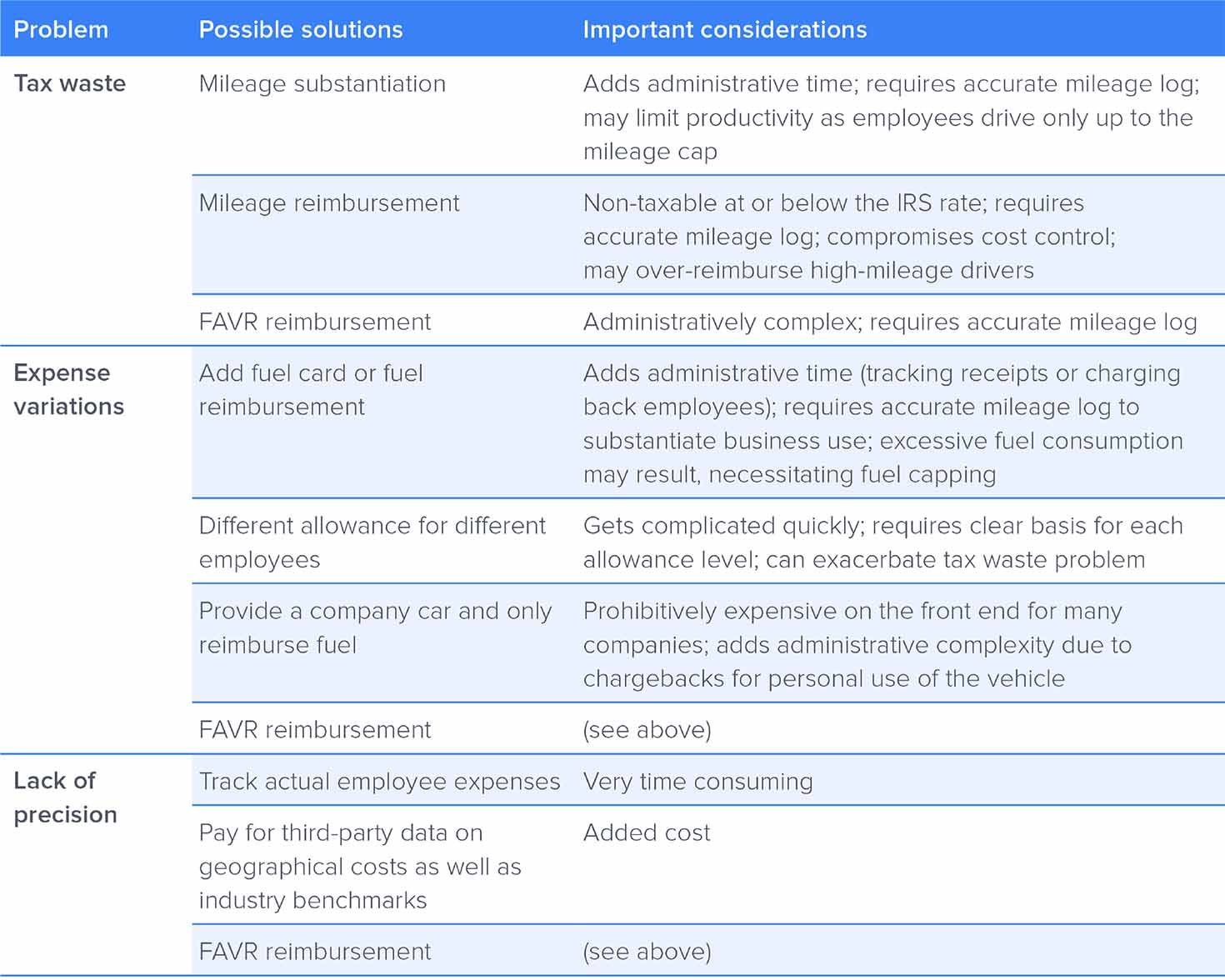

Ad Calculate Your Monthly Car Loan Payments With Tax And See Which Cars Fit Your Budget. Lets look at how tax can be different on the same salary using different methods. The IRS allows employees to calculate their car allowance for mileage reimbursement in the following ways.

01 March 2021 - 28 February 2022. Base their deductions on the expenses they incurred while driving. Work-related car expenses calculator.

5 of VAT inclusive cost of the car. Work-related car expenses calculator. Know Your Payment Options While You Shop With No Hit To Your Credit Score.

Ad Calculate Your Monthly Car Loan Payments And See Which Cars Fit Your Budget. Taxability of Motor Car Perquisite. Avalara provides supported pre-built integration.

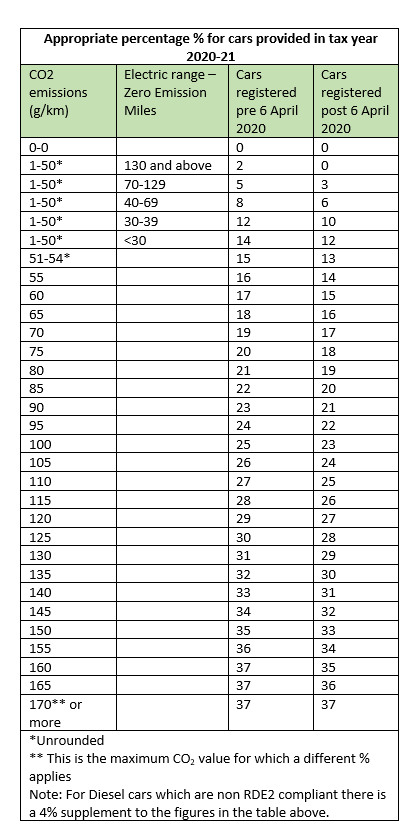

Or you can use HMRCs company car and car fuel benefit calculator if it works in your browser. A company car typically incurs much. If you have the choice of either a company.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. 8 hours ago Another consideration when pitting company car v allowance are the tax implications. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

It can be used for the 201314 to. Tax rates 2021-22 calculator. Tax rates 2022-23 calculator.

Using the HMRC calculator Choose fuel type F for diesel cars that meet the Euro 6d standard. Car allowance is based on the cost plus VAT x 35 without maintenance x number of. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees.

The online Tax Calculator and Car Allowance Calculator for the South African Salary and Wage earner. Whether the assessee is handicapped. Your results You can use this service to calculate tax rates for new unregistered cars.

24000 is the advertised price minus the dealer incentive and trade-in allowance. Monthly value of the use of the car for tax is 3. Tick if Yes Taxable Transport Allowance.

Tax rates 2021-22 calculator.

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

Doordash Taxes 19 Faqs Car Mileage Expenses For Dashers

Florida Vehicle Sales Tax Fees Calculator

Car Allowance Salary Sacrifice Or Company Car Free Comparison Calculator Download Youtube

Should You Take A Company Car Or A Car Allowance

Company Car Or Car Allowance What Do I Choose Youtube

What Is The Average Car Allowance For Executives I T E Policy I

Is Car Allowance Taxable Under Irs Rules I T E Policy I

Allowance Vs Cent Per Mile Reimbursement Which Is Better

Car Allowance Vs Mileage Reimbursement

2022 Everything You Need To Know About Car Allowances

2022 Car Allowance Policy Calculate The Right Amount

A Guide To Company Car Tax For Electric Cars Clm

2022 Everything You Need To Know About Car Allowances

Car Benefits Data Input Calculation 2020 21 Moneysoft

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Travel Allowance Or Company Car Which Is Better Contador Accountants